Introduction

The transition to electric vehicles (EVs) is one of the most significant shifts in the automotive and transport sector, and the United Kingdom is very much part of this change. This article presents a detailed analysis of EV ownership growth in the UK, drawing on the latest data, sectoral drivers, challenges, and what this means for the future.

Current State of EV Ownership in the UK

To understand growth, we first need to know where the UK stands today.

Stock of EVs on UK Roads

According to Society of Motor Manufacturers and Traders (SMMT) data, the number of battery-electric vehicles (BEVs) in the UK hit the one-million mark in 2024, with a total of approximately 1.334 million BEVs. motortradenews.com+2SMMT+2

In the broader category of plug-in vehicles (BEVs + plug-in hybrids, PHEVs), the figure was about 2.157 million units, representing roughly 5.1% of the total vehicle parc. motortradenews.com+2Zapmap+2

Meanwhile, vehicle ownership overall reached a new high: in 2024 the UK vehicle parc stood at approximately 41.96 million vehicles, up 1.4% year-on-year. SMMT+1

New Registrations and Market Share

It’s valuable also to look at what share of new car registrations EVs represent, as this gives a sense of the momentum. According to data compiled by Zap-Map and others:

-

In 2024, BEVs accounted for around 19.6% of all new car sales in the UK. Zapmap+1

-

The number of new BEV registrations in 2024 was approximately 381,970 units. EV+1

-

As of end-September 2025, fully electric cars numbered over 1.7 million, representing about 4.99% of the roughly 34 million cars on UK roads. Zapmap

Historical Growth

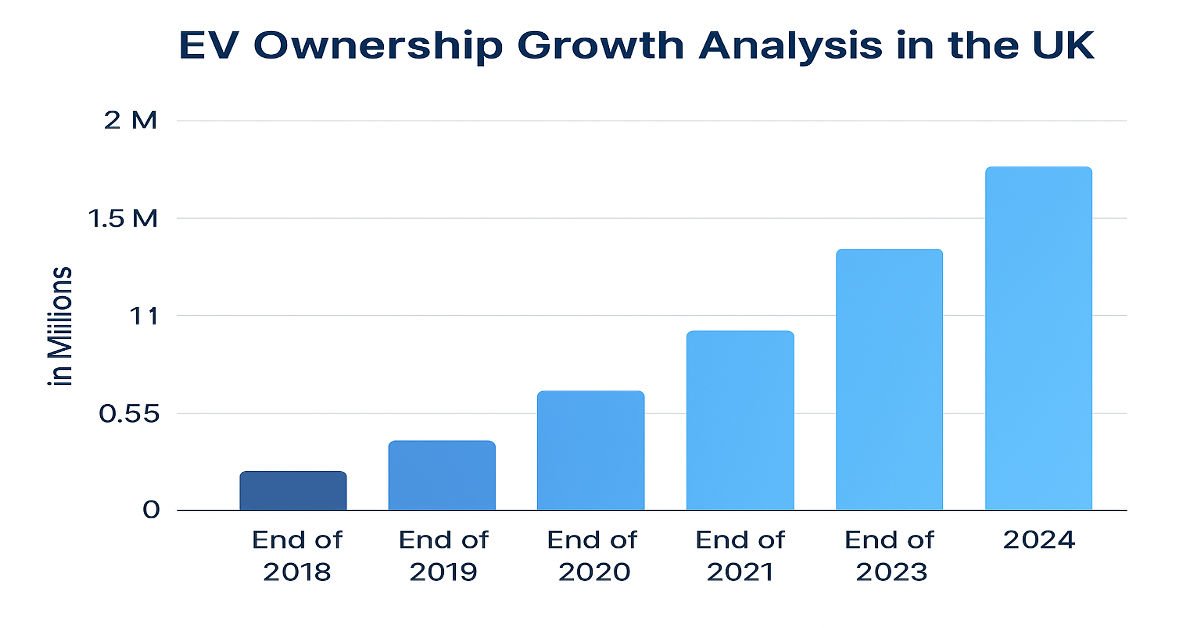

The growth rate of EV ownership has been striking. From the data:

-

At the end of 2021, there were about 396,945 fully electric cars, which was around 1.2% of all cars.

-

By mid-2024, private EV ownership had increased ten-fold when compared to the earlier part of the decade.

-

The compound annual growth rate (CAGR) for private EV ownership since 2018 has been over 60% in the UK.

Here is a table summarising some of the data points:

| Year | Approximate BEV Stock | BEV Stock as % of Cars | New BEV Registrations | BEV Share of New Cars |

|---|---|---|---|---|

| End 2021 | ~396,945 | ~1.2% | — | ~11.6% (2021 new cars) |

| End 2023 | ~1.0 million+ (parc) | ~3.7% of cars (2024) | ~314,684 (2023) | ~16.5% (2023) |

| End 2024 | ~1.334 million BEVs | ~3.7% of cars (2024) | ~381,970 (2024) | ~19.6% (2024) |

Key Drivers of EV Ownership Growth

Understanding growth means looking at why EV ownership is rising. Several major factors are contributing in the UK context.

Government Policy and Incentives

Government policy has long been a significant driver of EV uptake. Although the UK has seen fluctuations in the strength of incentives, the following have been important:

-

The presence of purchase grants (though recently scaled back), tax incentives, lower Company Car tax rates for EVs, and other fiscal measures.

-

The expansion of charging infrastructure, which reduces one of the major adoption barriers (charging anxiety). For example, the UK improved in the PwC e-Readiness survey, climbing to 5th out of 13 European countries in 2025, driven by infrastructure rollout, wider model range and some reinstated grants.

-

Pressure on manufacturers via zero-emission vehicle (ZEV) mandates (i.e., setting minimum shares of new car sales to be zero-emission vehicles) — such mandates drive manufacturers to ramp up EV supply, which in turn affects availability and pricing.

Increasing Model Variety and Price Adjustments

As supply of EVs has grown, so has competition, which helps drive down prices and broaden consumer choice:

-

More affordable EV models are emerging and used EV prices are falling, making them within reach of more buyers. For instance, in 2024 used EV sales in the UK rose by 57.4% compared to the prior year, as prices eased.

-

According to PwC, one of the reasons the UK’s eReadiness improved was “price reduction of Electric Vehicles (EVs) and the rollout of EV infrastructure”.

Charging Infrastructure & Technology Advances

The availability of charging infrastructure and improvements in battery technology are essential enablers:

-

The number of public charge points in the UK increased significantly — for example, the PwC survey reported a 26% increase in charge points in 2024.

-

Improved driving ranges, faster charging times, and more trusted technology reduce ‘range anxiety’ and other perceived risks of EV ownership.

Fleet & Business Adoption

A substantial portion of EV uptake is driven by fleets and businesses, which accelerate scale and visibility:

-

One article notes that in 2024 almost 60% of EVs on UK roads were registered to businesses.

-

Fleet adoption often creates second-hand supply, which helps lower cost barriers for private buyers over time.

Segmentation & Ownership Patterns

Within the broader picture, it’s instructive to examine how different segments of the market are behaving.

Private vs Business Ownership

The growth in private individual ownership remains slower than the fleet/business sectors:

-

While overall EV numbers are rising quickly, private purchase growth has sometimes lagged. According to The Eco Experts, fewer than one in six new BEVs bought in April 2024 went to consumers – corporate/fleet purchases dominate.

-

Data shows that the owner profile is skewed towards higher-income individuals, often in metropolitan areas.

Geographic & Demographic Differences

Regional and demographic differences matter for equity and future growth potential:

-

Academic work shows uptake disparities between regions (for example, urban vs rural, or South East vs West Midlands) in the UK.

-

From the survey of UK consumers by PwC and others, issues like cost, charging infrastructure availability and battery range concerns are more acute for less affluent and less urban buyers.

Challenges and Barriers to Growth

Despite the strong growth, the UK EV market still faces considerable barriers that could slow further adoption.

Up-front Costs and Affordability

Even though purchase prices are decreasing, the upfront cost of EVs remains higher than many traditional vehicles, especially for private buyers in lower income brackets. In the PwC survey, price was the most cited barrier (65% of respondents).

Additionally, tax and regulatory changes may affect perceptions of value for money (for example, changes to vehicle excise duty or benefits for company car users).

Charging Infrastructure and Home Charging Access

While public charging infrastructure is expanding, challenges remain:

-

Some regions and property types (e.g., flats, terraced homes without off-street parking) have more difficulty accessing home or off-street charging.

-

According to one report, about 30% of key roads still lack DC fast chargers.

-

Even with infrastructure growth, consumer anxiety about charging availability and reliability persists.

Range Anxiety, Battery Life and Technology Perceptions

Though improved, concerns about range, battery life, and long-term reliability remain important:

-

In the PwC UK survey, top concerns included charging time, limited range and battery life uncertainties.

-

Some owners still consider reverting to internal combustion vehicles, due to perceived risks or costs.

Policy Uncertainty

Regulatory and policy changes can introduce uncertainty:

-

For example, the UK’s market attractiveness may be affected by changes to purchase incentives, taxation, ZEV mandates, and import competition.

-

According to PwC, the UK’s e-Readiness declined in 2024 partly because of weakened purchasing incentives.

Forecasts and Future Growth Potential

Given the current base and growth dynamics, what is likely for EV ownership in the UK going forward?

Market Potential

There is still a large “headroom” for growth:

-

Even though there are over a million BEVs, they still make up a relatively small share of the total car parc. For example, in June 2024 the share of zero-emission vehicles was around 2.7% of all cars.

-

If the aim is net zero or substantial decarbonisation of transport by 2030 and beyond, then the growth rate must accelerate.

Growth Scenarios

Several plausible scenarios exist:

-

Continuing current trends of ~20% of new cars being BEVs could gradually raise the overall parc share year on year.

-

If infrastructure, model availability (especially in more affordable segments), and cost curves improve significantly, then a faster acceleration is possible.

-

However, to hit more ambitious climate or regulatory targets (for example full transition to zero-emission by 2030), a steeper adoption curve is required.

Policy & Market Implications

Key factors that will influence the pace of growth include:

-

Government incentives and regulatory certainty (including tax, grants, ZEV mandates)

-

Speed of charging infrastructure build-out, especially fast charging and access for multi-unit dwellings

-

Cost reductions in batteries and EV manufacturing, which will bring down prices and increase model availability

-

Consumer awareness, second-hand market development (making EVs more accessible to more buyers)

-

Supporting ecosystem such as grid readiness, vehicle-to-grid (V2G) technologies, business models (charging at work, home, public)

Implications for Stakeholders

The growth of EV ownership in the UK has important implications across stakeholders — consumers, industry, government and infrastructure providers.

For Consumers

-

Private buyers should evaluate not just upfront cost but total cost of ownership (including lower running costs, tax benefits, maintenance savings).

-

Consideration of home charging, access to public charging, range, model choice and resale value remain important.

-

The second-hand EV market is expanding, offering more affordable entry, so timing and model selection matter.

For Industry and Automakers

-

Growing demand for EVs means automakers must scale production, ensure supply chain resilience (especially batteries) and deliver a range of models across segments.

-

Businesses should anticipate shifts in fleets (company cars) — EVs are increasingly becoming fleet defaults in some cases.

-

Infrastructure players (charging network operators, energy companies) must gear up for increased load, grid demands, interoperability and user experience.

For Government and Policy Makers

-

Policymakers must balance incentives, regulation and infrastructure investment to sustain momentum.

-

Equity concerns matter: ensuring that EV benefits and infrastructure access extend beyond affluent/private-urban buyers to wider populations.

-

Supporting the grid, planning for increased electricity demand, smart charging and load management becomes vital.

-

Monitoring and adjusting vehicle taxation, grants and mandates helps send clear signals to market.

Risks and Things to Watch

Growth is promising, but several risks and “wildcards” remain:

-

If supply chain constraints (e.g., battery materials) or component shortages bite, cost reductions may slow.

-

If charging infrastructure fails to keep up (especially in less-served areas), consumer adoption may stall.

-

If used EV resale values drop significantly or battery degradation becomes a concern, consumer confidence may suffer.

-

If policy or incentive changes introduce uncertainty (for example removal of grants, or introduction of extra taxes) this could slow demand.

-

Competition from imported low-cost EVs (especially from China) may reshape market dynamics in the UK, affecting domestic manufacturing and brand strategies.

Conclusion

The UK is clearly making rapid progress in EV ownership. From a modest base just a few years ago, there has been a dramatic rise in both the stock of EVs and the share of new registrations. The data show that BEVs are no longer niche but are becoming mainstream. Yet the journey is far from over: EVs still represent a small percentage of the total vehicle parc, and major challenges remain around cost, infrastructure, consumer access and policy consistency.

For website readers, the key take-aways are:

-

If you are considering EV ownership, the ecosystem is now strong and improving — buying now is a credible choice for many.

-

But do your homework: model range, charging availability, total cost of ownership and future resale value all matter.

-

For the industry and policy-makers, the current momentum must be sustained and widened to ensure that the transition to zero-emission transport becomes universal rather than partial.

In summary, EV ownership growth in the UK is robust and accelerating — but to achieve the full promise of electrified transport (lower emissions, cleaner air, reduced reliance on fossil fuels) the pace must continue to rise, distribution must become more equitable, and the entire supporting ecosystem must evolve to meet demand.

1 thought on “EV Ownership Growth Analysis in the UK”